More than ever, lenders need to adopt and trust technology. But too many approaches fragment the lending experience. Blend’s digital lending platform streamlines the process of getting a loan and eliminates unnecessary drama and anxiety from major life decisions.

Recorded Live on May 30, 2019 @ 11AM

Blend is excited to be the featured case study in The Boston Consulting Group’s first mortgage industry white paper of 2019.

The report details mortgage market conditions and how top lenders are fighting back against a tightening market using digital solutions. It provides an early look at results experienced by lenders using the Blend platform.

When consumers engage with banks, they aren’t in search of financial products. They’re looking for help to achieve their goals.

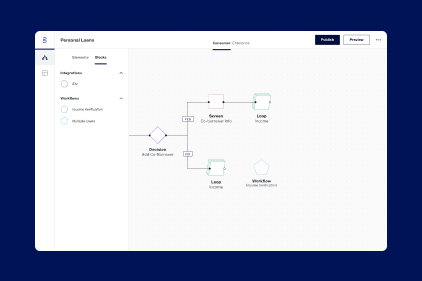

Platforms allow for a high-tech and high-touch approach to lending. The good ones are flexible enough to support all major retail banking products and provide a consistent experience across channels.

Get known for better lending.

Delivering a consumer journey from application to close that is simple, safe, and fast. Increasing lender productivity, while enabling deeper customer relationships. It’s the complete package.

Compliance by leadership. Compliance by design. Compliance by default. Our three-tier philosophy empowers lenders.

Some stat from the 10 minute guide

Some stat from the 10 minute guide

Some stat from the 10 minute guide

Title / Company

Title / Company

Title / Company

11. Amazon, Netflix, and Uber continually elevate consumer expectations for all industries. Credit union members now expect both digital simplicity and smart local advice across all marketing and transactional engagement.

In this can't-miss session, we analyze results of a brand new study showing where credit unions are strong and where they must improve to stay ahead of member expectations in this modern era.

13. Nowhere have I heard of a comparable synergy like what we have experienced with Blend. It truly is a partnership.

Jared Devito

Chief Information Officer, Movement Mortgage

Whether in a branch or through a mobile interaction, Blend helps you impress consumers at the beginning of their journey — and at every step along the way.

Blend automates and eliminates manual processing tasks that delay pre-approvals, giving loan teams more time for the things that matter most.

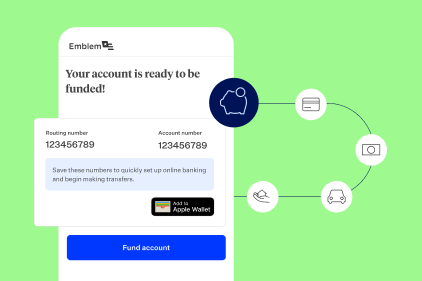

Blend offers support for multiple lending products on the same platform — helping you deepen customer relationships in a safe and secure way.

We will reach out shortly to schedule some time to chat. In the meantime, check out the latest from our blog

Blend is excited to be the featured case study in The Boston Consulting Group’s first mortgage industry white paper of 2019. The report details mortgage market conditions and how top lenders are fighting back against a tightening market using digital solutions. It provides an early look at results experienced by lenders using the Blend platform.

Guides & Whitepaper

Guides & Whitepaper

Guides & Whitepaper