Trade up from disconnected

loan origination

Today’s borrowers expect a simple, personalized digital experience. It’s time to modernize your mortgage lending.

Trusted by financial institutions

for excellence and innovation

Why Blend

Blend takes lending where

other tools can’t

Minimize extra processes and offer your borrowers

proactive and personal digital journeys that

get them into homes faster.

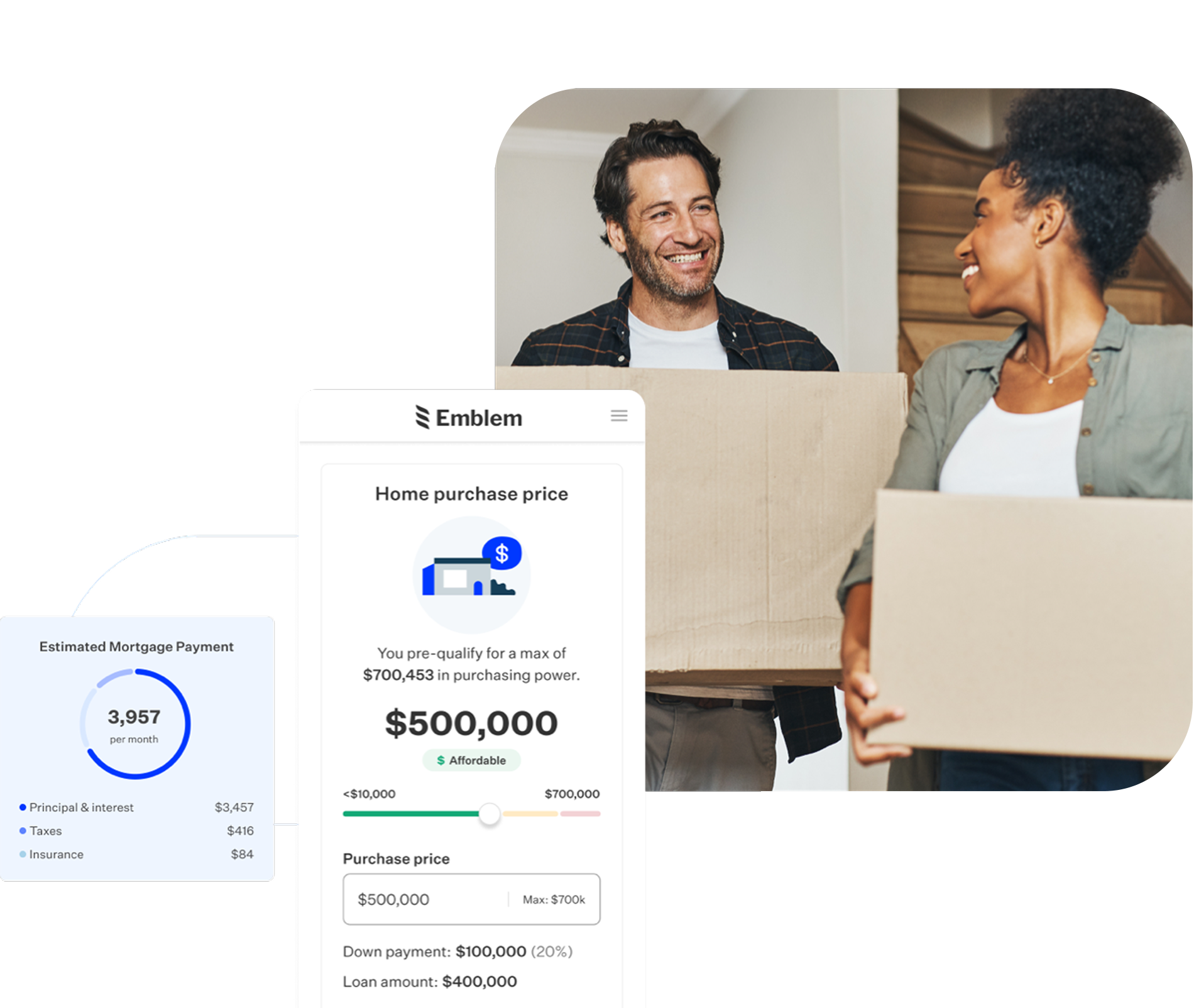

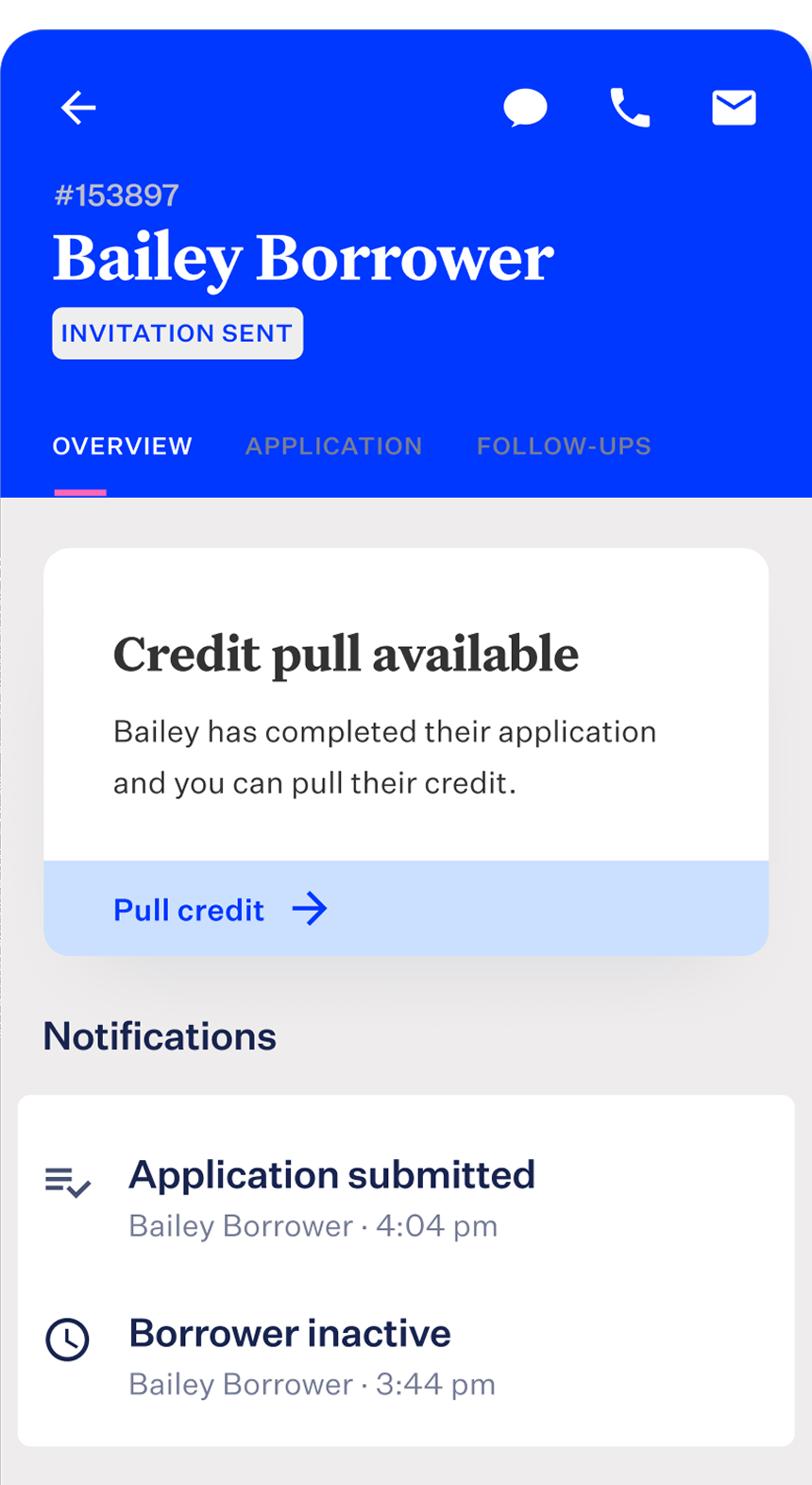

One simple, unified tool

Lenders and borrowers can access all loan documents and artifacts from one secure portal.

Delivering real results

Simplify your workflows and get to decisions at lightning speed. Save $650 per loan and close 9 days faster.

Fully automated workflows

Instant verifications across assets, credit, income, and employment help close loans faster.

Integrated seamlessly

Deep LOS integration makes data available without having to repeat steps or upload more documents.

Replace catching up with

a commanding lead

Keeping up with a constantly fluctuating market is a big challenge, especially without flexible, unified tools that provide an end-to-end digital experience. But with a market-aligned strategy, you can capture and keep more home lending borrowers. Learn how in our latest ebook.

Put ROI on repeat

Lending and borrowing are document-intensive processes that require detailed information. Understanding how bottlenecks and inefficiencies impact closing rates is key to staying competitive. Watch our on-demand webinar for an expert-led exploration of the link between mortgage operations and ROI.

Trade up your mortgage experience

Get an expert walk-through of Blend.

Bank streamlines for borrowers

American Federal Mortgage worked with Blend to eliminate extra tools and workflows to save time and complication.

Bank brings lending online

US Bank transformed itself from manual processes to a fully digital mortgage provider, without losing its human touch.

Mortgage apps jump up 40%

Compass Mortgage transformed its lending process to enable more borrowers from more backgrounds to close on homes.